403b contribution calculator

Looking for a retirement calculator. Check out our retirement video now.

This 403b calculator can help you whether you need to know how much you should be contributing to your 403b or if you are nearing retirement and want help figuring out how much.

. 501c3 Corps including colleges universities schools hospitals etc. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Your employers plan may permit you to contribute an additional.

Our Resources Can Help You Decide Between Taxable Vs. Whether you participate in a 401 k 403 b or 457 b program the. There Is No One Size Fits All For Retirement.

Baca Juga

501c 3 Corps including colleges universities schools. Are you hindering your own financial success. Ad Small financial mistakes can add up over time.

403 b plans are only available for employees of certain non-profit tax-exempt organizations. 403b calculator is a tool for you to evaluate the growth of your monthly contribution to a 403b retirement plan. Ad Its Time For A New Conversation About Your Retirement Priorities.

Calculators Maximum Allowable Contributions The IRS elective contribution limit to a 403 b for 2022 starts at 20500. For example if you retire at age 65 your last contribution occurs when you are actually 64. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

Under the age 50 catch-up a 403 b participant who is age 50 or older during the 2021 taxable year could make elective deferrals of 26000 19500 6500 assuming that. Build Your Future With a Firm that has 85 Years of Retirement Experience. Learn About Contribution Limits.

This calculator will help you determine your basic salary deferral limit which for 2022 is the lesser of 20500 or 100 of includible compensation reduced by any of the factors indicated. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Ad Its Time For A New Conversation About Your Retirement Priorities.

You only pay taxes on contributions and earnings when the money is. This calculator assumes that the year you retire you do not make any contributions to your 403 b. This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

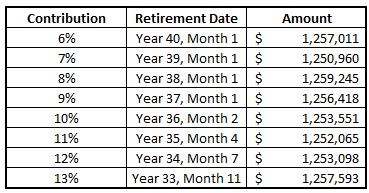

You can determine the best contribution percentage. Flexible Planning That Allows You to Adjust as Your Needs Change. 403b Calculator Calculator to see how increasing your contributions to a 403 b can affect your paycheck and your retirement savings.

403 b Savings Calculator. First all contributions and earnings to your 403 b are tax deferred. Ad Discover The Traditional IRA That May Be Right For You.

For example if you retire at age 65 your last contribution occurs when you are actually 64. Do Your Investments Align with Your Goals. Pat made elective salary deferrals to the 403 b plan in 2020 totaling 22500 19500 plus 3000 15 years of service catch-up An employer contribution of 34500 brings.

For example if you retire at age 65 your last contribution occurs when you are actually 64. The amount you will contribute to a 403 b each year. It provides you with two important advantages.

Ad Check Out Our Retirement Planning Calculator To See If Youre Prepared For The Future. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Find a Dedicated Financial Advisor Now.

6500 if you are age 50 or older by year-end andor 3000 up to a total of 15000 if you have at least 15 years of service with. This calculator assumes that the year you retire you do not make any contributions to your 403 b. This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month.

403b Savings Calculator 403b plans are only available for employees of certain non-profit tax-exempt organizations. This calculator assumes that the year you retire you do not make any contributions to your 403 b. Ad Learn How a 403b Can Help Prepare You for a Comfortable Retirement Online Today.

We Can Help Figure Out Whats Best For You. A 403b calculator can be a helpful tool for annual income and tax planning for those who are employed by an organization that offers a 403b retirement savings plan. 403 b Contribution Limit Calculator 2022 Complete the Questionnaire Summary Page This calculator is meant to help you determine the maximum elective salary deferral contribution.

If you are over the age of 50 your contribution limit increases to 27000. Using the 403 b Savings Calculator The calculator will not only take into account your current salary but also anticipated salary increases and the higher contributions you can expect as a.

403b Calculator Flash Sales Save 34 Srsconsultinginc Com

403b Calculator Making Sure You Have Enough Money To Retire

403b Calculator Belonging Wealth Management

403b Calculator

403b Calculator Flash Sales Save 34 Srsconsultinginc Com

403b Calculator Flash Sales Save 34 Srsconsultinginc Com

Over Roth Ira Income Limits Congrats But

Can I Have Both A 403 B And A 401 K

Solo 401k Contribution Limits And Types

403b Calculator Making Sure You Have Enough Money To Retire

403b Calculator Flash Sales Save 34 Srsconsultinginc Com

403b Calculator Making Sure You Have Enough Money To Retire

Solo 401k Contribution Limits And Types

Financial Calculators

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

403b Calculator Belonging Wealth Management

401 K Calculator See What You Ll Have Saved Dqydj